Her background in education allows her to make complex financial topics relatable and easily understood by the layperson. She is the author of four books, including End Financial Stress Now and The Five Years Before You Retire. Here’s what you need to know about how to balance a checkbook in a paperless world. It’s similar to how you use a fingerprint or facial recognition to unlock your phone. The public rollout started earlier this year, when it became possible for passkeys to sync across all platforms. The login code generated by the passkey is unique every time—and encrypted—so it’s useless to a criminal.

Are Passkey’s Portable?

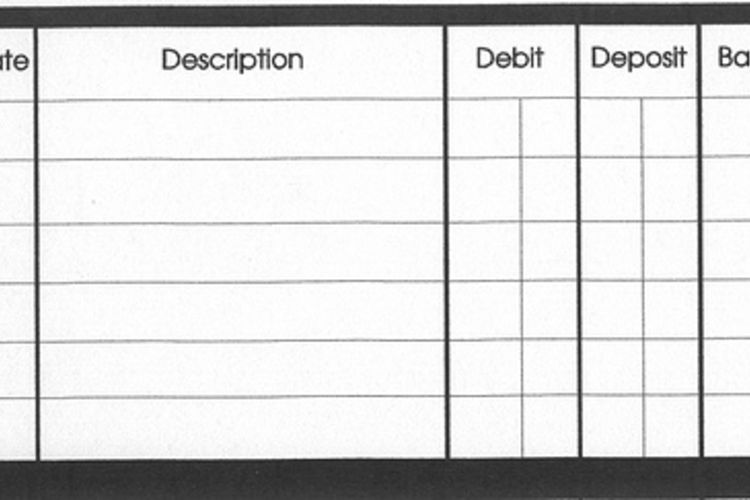

For example, if you have $1,000 in your checking account and spend $50 on food, you’ll adjust your balance to $950 after you enter it in your register. Now you know that you have $950 left to spend from your account, rather than what shows as your current bank account balance of $1,000. Your bank or credit union should issue a monthly account statement in the mail or online. This usually lists the balance from the previous month’s statement, along with deposits, other credits, debit and check that have been cleared through the bank. It should also include your ending account balance on the date the statement was generated.

Step 2. Compare your personal check register to your bank statement

A checkbook typically consists of a pad with paper checks you can use to pay bills and make purchases with the money in your checking account. Writing down transactions in a checkbook register is one way to keep track of them, but there are also options for balancing your checkbook digitally. You add or subtract the corresponding amount to arrive at your new account balance. This can help with balancing your checkbook at the end of the month.

How do you keep checks secure?

- With the invention of online banking, some people might not even know how to write a check or have a checkbook at all.

- As an online checkbook, you enter your receipts into the site and assign each transaction to an account and category.

- Though both parts of the word “checkbook” are quickly becoming meaningless, being able to reconcile your accounts will always be an important part of financial health.

- It may be that only old-school account holders still record and reconcile paper checkbooks by hand.

- When filling out your check register, you must know all the details about the transaction, including things like the transaction amount, date of the transaction, and what it was for.

You also can sign up for email or text alerts that will let you know everything from when your transactions clear to what your current balance is. These amenities make it very easy to check your banking information each day. The old-school method of checkbook balancing assumed that you would carry a paper check register with you everywhere you went, and that you would record your transactions by hand. It also assumed that your transactions consisted primarily of paper checks going into and out of your account. However, even though the paper-and-pencil aspect of checkbook balancing has mostly gone the way of the dodo, the process is still a necessary part of maintaining your checking account. But whether you were a master checkbook balancer in the time of paper or are a digital native who didn’t realize paper statements were once a thing, you may not know exactly how to reconcile your accounts.

Privacy and Security Focused Money Management

To reconcile your transactions, go through your bank statement line by line. You’re looking to match up the “cleared” charges that are on your bank statement (meaning charges that hit your account and have been paid) with charges that you’ve listed in your register. Each time you enter in a new transaction, make sure to update your balance.

Financial institution reviews

Include tiny amounts of interest that your account may have earned and services fees the bank might have charged you. Making a practice of doing this consistently will help you avoid small discrepancies when reconciling your bank statements. If you struggle to get into this kind of habit, a number of modern banking conveniences can help remind you to check in once a day. For instance, the majority of modern banks offer smartphone apps that allow you to easily check your balance, see your transactions and even deposit checks via your phone.

There are a number of programs available that will automatically track your banking information for you, such as Mint.com and Personal Capital. These aggregators allow you to see an overview of all of your financial accounts in a single place, from your checking and savings accounts, to your loans, to your college savings account. Such an aggregator will do the tracking and recording for you, so all you’ll have to do is check it regularly and compare it to your banking information to make sure everything balances.

The third (shorter) number is a four-digit check identifier that is different for each check. Though you don’t have to write them in numerical order, most people do to avoid confusion. Checkbooks are not used as often as they used to be, but you might need to use a check in some instances. For example, your landlord might not accept credit or debit cards if you rent an apartment.

However, depending on your type of spreadsheet, you may be able to set up formulas to do the balance calculations for you (e.g., beginning, current, and ending balances). When filling out your check register, you must know all the details about the transaction, including things like the transaction amount, date of the transaction, and what it was for. Now that you’ve reviewed every transaction, your account should be free of any surprises. Once you’ve added the deposits and subtracted the debits, you’ll see the new balance of your account. As a small business owner, you want to grow your business so that you can bring in a comfortable amount of revenue and achieve your professional goals. Budgeting properly so that you know how much money you have to put toward different investments while also building your savings account plays a critical role in business growth.

So, if identity thieves get that password, it’s easier for them to access all the victim’s accounts. Take a tour of our financial tools and see if ClearCheckbook is checkbook accounting the right tool for helping you manage your money. Manually creating your check register using a pencil and paper is a good option if you’re looking to save a buck.